Understanding the Significance of Household Financial Resources: A Comprehensive Exploration

Related Articles: Understanding the Significance of Household Financial Resources: A Comprehensive Exploration

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the Significance of Household Financial Resources: A Comprehensive Exploration. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Significance of Household Financial Resources: A Comprehensive Exploration

The concept of "household income" is a fundamental aspect of economic analysis and social well-being. It represents the total financial resources available to a group of individuals living together, providing a crucial indicator of their economic capacity and standard of living. This article delves into the multifaceted nature of household income, exploring its components, significance, and implications for individuals, families, and society as a whole.

Defining the Scope of Household Financial Resources:

Household income encompasses all sources of financial inflow that a group of individuals sharing a residence can access. This includes:

- Earnings from employment: Wages, salaries, bonuses, commissions, and other forms of compensation for work performed.

- Self-employment income: Profits generated from self-owned businesses or freelance work.

- Government transfers: Social security payments, unemployment benefits, welfare assistance, and other forms of government support.

- Investment income: Interest earned on savings accounts, dividends from stocks, and capital gains from investments.

- Retirement income: Pensions, annuities, and other forms of income received after retirement.

- Other income sources: Alimony, child support, rental income, and gifts.

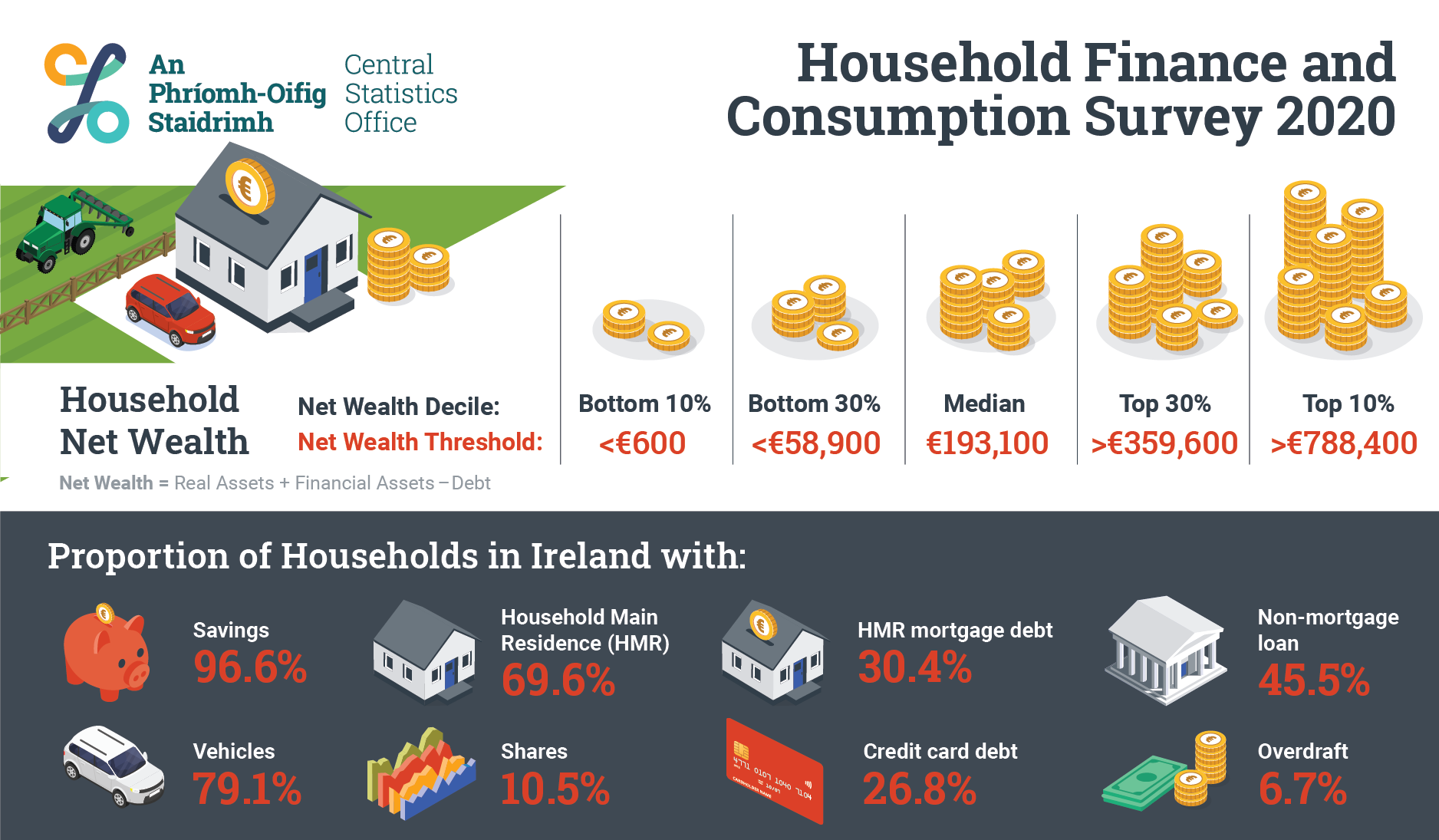

It’s crucial to note that household income does not include the value of assets like homes, cars, or savings. These assets represent wealth, which is distinct from income, though it can influence spending power and financial security.

Significance of Household Financial Resources:

Household income plays a pivotal role in determining the economic well-being of individuals and families. It serves as a primary indicator of:

- Standard of living: The level of material comfort and access to goods and services that a household can afford. Higher income typically translates to a higher standard of living, allowing for better housing, healthcare, education, and leisure activities.

- Financial security: The ability to meet basic needs and unexpected expenses without experiencing significant financial strain. Adequate income provides a buffer against economic shocks and promotes financial stability.

- Social mobility: The ability to move up the economic ladder and improve one’s socioeconomic status. Higher income often leads to better education, employment opportunities, and access to resources that facilitate upward mobility.

- Economic growth: Aggregate household income drives consumer spending, which is a significant contributor to economic growth. Increased household income stimulates demand for goods and services, supporting businesses and creating jobs.

- Social equity: The distribution of household income across different segments of society reflects the level of economic equality. A more equitable distribution of income promotes social cohesion and reduces poverty.

Factors Influencing Household Financial Resources:

Numerous factors influence the level of household income, including:

- Education and skills: Higher levels of education and specialized skills are generally associated with higher-paying jobs.

- Occupation and industry: Some occupations and industries offer higher wages and salaries than others.

- Location: Income levels can vary significantly across different geographic regions due to factors like cost of living, industry concentration, and labor market dynamics.

- Age and experience: Income tends to increase with age and experience, as individuals gain more skills and move up the career ladder.

- Family structure: Household income is influenced by the number of earners and dependents within a household.

- Government policies: Tax policies, social welfare programs, and labor market regulations can impact income levels and distribution.

Understanding the Impact of Household Financial Resources:

The level of household income has far-reaching implications for individuals, families, and society as a whole.

Individual Level:

- Health and well-being: Adequate income allows individuals to access quality healthcare, nutritious food, and safe housing, contributing to their physical and mental health.

- Education and opportunities: Higher income provides opportunities for children to receive quality education and pursue higher education, increasing their future earning potential.

- Financial stability and security: Stable income reduces financial stress and anxiety, allowing individuals to save for retirement, invest, and plan for the future.

Family Level:

- Family well-being: Higher household income allows families to provide for their children’s needs, foster a positive family environment, and invest in their future.

- Social mobility: Families with higher incomes are more likely to accumulate wealth and pass it on to their children, contributing to intergenerational social mobility.

- Family stability: Adequate income reduces financial strain and conflict, contributing to family stability and well-being.

Societal Level:

- Economic growth: As mentioned earlier, aggregate household income drives consumer spending, which is a key driver of economic growth.

- Social equity: The distribution of household income reflects the level of economic equality in society. Reducing income inequality promotes social cohesion and reduces poverty.

- Public services: Higher household income allows governments to collect more tax revenue, which can be used to fund essential public services like healthcare, education, and infrastructure.

FAQs on Household Financial Resources:

1. How is household income measured?

Household income is typically measured through surveys, such as the U.S. Census Bureau’s Current Population Survey, which collect data on income sources and amounts for a representative sample of households.

2. What are the limitations of using household income as a measure of economic well-being?

Household income is a useful indicator, but it has limitations. It does not capture the value of assets, which can contribute to wealth and financial security. It also doesn’t account for factors like cost of living variations, access to public services, or non-monetary benefits like health and education.

3. How can household income be increased?

Increasing household income involves addressing the factors that influence it. This includes promoting education and skill development, creating opportunities for job creation and wage growth, providing access to affordable housing, and implementing policies that support families and low-income households.

4. What are the implications of income inequality?

Income inequality can lead to social unrest, reduced economic growth, and a decrease in social mobility. It can also exacerbate health disparities, limit access to quality education, and undermine social cohesion.

Tips for Managing Household Financial Resources:

- Create a budget: Track income and expenses to understand spending patterns and identify areas for savings.

- Save regularly: Set aside a portion of income for emergencies, retirement, and future goals.

- Reduce debt: Prioritize paying off high-interest debt to minimize financial burden.

- Invest wisely: Consider diversifying investments to manage risk and potentially grow wealth over time.

- Seek financial guidance: Consult with financial advisors for personalized advice and guidance on managing finances.

Conclusion:

Household income is a fundamental indicator of economic well-being, reflecting the financial resources available to individuals and families. It plays a crucial role in determining standard of living, financial security, social mobility, and economic growth. Understanding the factors influencing household income and its implications is essential for policymakers, businesses, and individuals alike. By promoting policies that support income growth, reduce inequality, and provide access to resources, society can foster economic prosperity and improve the well-being of its citizens.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Significance of Household Financial Resources: A Comprehensive Exploration. We appreciate your attention to our article. See you in our next article!