The American Spending Landscape: A Look at Common Financial Missteps

Related Articles: The American Spending Landscape: A Look at Common Financial Missteps

Introduction

With great pleasure, we will explore the intriguing topic related to The American Spending Landscape: A Look at Common Financial Missteps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The American Spending Landscape: A Look at Common Financial Missteps

The American economy thrives on consumer spending, but a significant portion of this expenditure often goes towards unnecessary purchases and financial missteps. Understanding these common financial pitfalls can empower individuals to make more informed decisions, improve financial well-being, and achieve long-term financial goals.

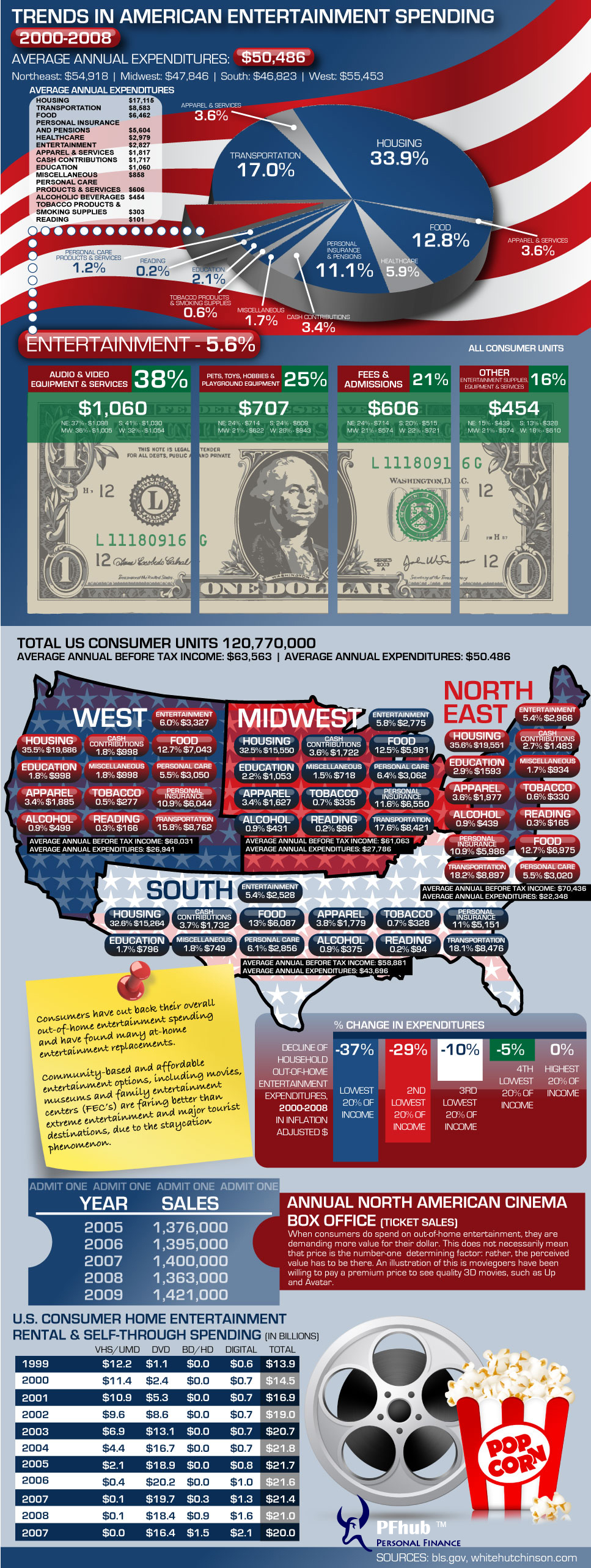

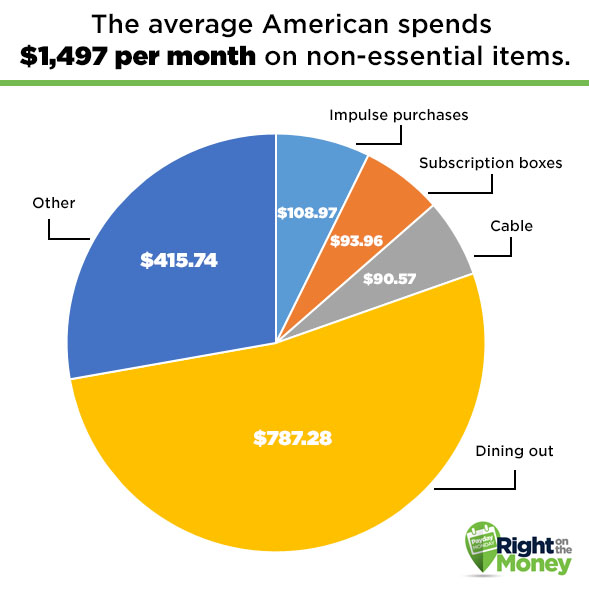

1. Impulse Buying and Overspending

The allure of instant gratification often leads to impulsive purchases. This includes unplanned shopping sprees, online browsing sprees, and succumbing to marketing tactics that trigger immediate desires. Overspending, a close cousin of impulse buying, occurs when individuals exceed their budget, often driven by social pressures, keeping up with trends, or simply a lack of awareness of actual spending habits.

FAQs on Impulse Buying and Overspending:

-

Q: How can I curb impulse buying?

- A: Develop a shopping list before venturing out, leave credit cards at home, and give yourself a "cooling-off" period before making a significant purchase.

-

Q: What are the signs of overspending?

- A: Feeling overwhelmed by debt, constantly using credit cards to cover basic expenses, and experiencing anxiety about money are red flags.

Tips for Avoiding Impulse Buying and Overspending:

- Track spending: Regularly monitor spending patterns to identify areas where overspending occurs.

- Create a budget: Establish a realistic budget that aligns with financial goals and stick to it.

- Delay gratification: Resist immediate gratification by giving yourself time to consider if a purchase is truly necessary.

2. Subscription Services and Recurring Fees

The subscription model has become pervasive, offering convenience and access to a wide array of services. However, the sheer number of subscriptions can easily spiral out of control, leading to recurring fees that drain the bank account. Many individuals subscribe to services they rarely use or forget they even signed up for.

FAQs on Subscription Services and Recurring Fees:

-

Q: How do I avoid unnecessary subscriptions?

- A: Regularly review subscriptions and cancel those not actively used. Utilize free trials before committing to paid subscriptions.

-

Q: How can I manage recurring fees effectively?

- A: Set up reminders for recurring payments and consider bundling services to reduce costs.

Tips for Managing Subscriptions and Recurring Fees:

- Automate cancellations: Utilize tools that automatically cancel subscriptions after a trial period or when usage drops below a certain threshold.

- Negotiate better rates: Explore options for negotiating lower rates or discounts on existing subscriptions.

- Consider alternatives: Explore free or less expensive alternatives to paid subscriptions.

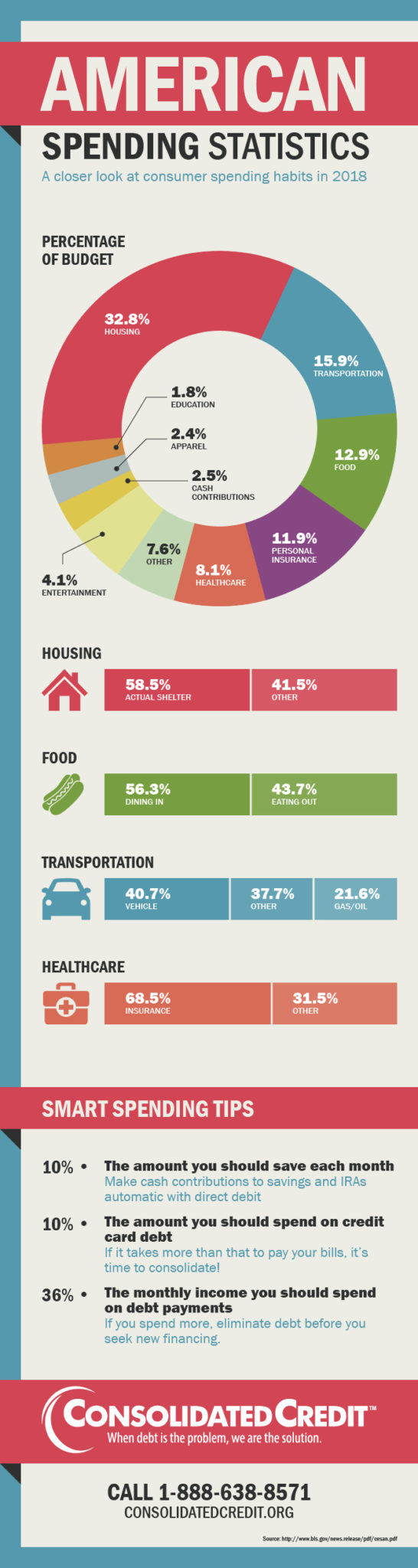

3. Dining Out and Entertainment

Eating out and entertainment expenses can quickly add up, especially when indulging in pricey restaurants or attending numerous events. While enjoying social outings is essential for well-being, it’s crucial to find a balance that doesn’t strain the budget.

FAQs on Dining Out and Entertainment:

-

Q: How can I reduce dining out expenses?

- A: Explore cooking at home more often, opt for less expensive dining options, and take advantage of restaurant deals and discounts.

-

Q: What are some cost-effective entertainment options?

- A: Consider free or low-cost activities like visiting parks, attending community events, or exploring local museums.

Tips for Managing Dining Out and Entertainment Expenses:

- Plan ahead: Make a list of activities and budget accordingly before going out.

- Prioritize experiences: Focus on spending on experiences that truly matter, rather than frivolous purchases.

- Explore free alternatives: Take advantage of free events and activities in the community.

4. Transportation Costs

Transportation is a necessity, but the cost of owning and maintaining a vehicle, coupled with fuel prices, can significantly impact personal finances. Unnecessary car trips, inefficient driving habits, and failing to explore alternative transportation options can exacerbate these costs.

FAQs on Transportation Costs:

-

Q: How can I reduce fuel costs?

- A: Combine errands, utilize public transportation or ride-sharing services, and practice fuel-efficient driving techniques.

-

Q: Are there alternatives to car ownership?

- A: Explore options like carpooling, bike-sharing, or walking for shorter distances.

Tips for Managing Transportation Costs:

- Consider alternative transportation: Explore public transportation, ride-sharing, or cycling for daily commutes or errands.

- Maintain your vehicle: Regular maintenance can improve fuel efficiency and prevent costly repairs.

- Shop around for insurance: Compare insurance quotes and consider increasing your deductible to lower premiums.

5. Home Improvement and Renovations

Home improvement projects can be enticing, but they often come with a hefty price tag. Overspending on renovations, undertaking projects without proper planning, and neglecting essential maintenance can lead to financial strain.

FAQs on Home Improvement and Renovations:

-

Q: How can I avoid overspending on home improvements?

- A: Set a realistic budget, prioritize projects based on need and value, and compare quotes from different contractors.

-

Q: What are some DIY options for saving money?

- A: Explore DIY projects for tasks like painting, landscaping, or minor repairs.

Tips for Managing Home Improvement Costs:

- Plan and research: Thoroughly research projects, gather estimates, and develop a detailed plan before starting.

- Prioritize needs over wants: Focus on essential repairs and improvements that increase value or safety rather than cosmetic upgrades.

- Seek professional advice: Consult with contractors or experts for complex projects to avoid costly mistakes.

6. Credit Card Debt and Interest Charges

Credit cards offer convenience, but they can quickly become a financial burden if not managed responsibly. Carrying a balance on credit cards results in hefty interest charges that can snowball over time, hindering financial progress.

FAQs on Credit Card Debt and Interest Charges:

-

Q: How can I avoid credit card debt?

- A: Pay off balances in full each month, use credit cards sparingly, and avoid using them for cash advances.

-

Q: How can I manage existing credit card debt?

- A: Consider debt consolidation options, balance transfer cards with lower interest rates, or utilize debt management programs.

Tips for Managing Credit Card Debt:

- Prioritize debt repayment: Focus on paying down high-interest debt first.

- Negotiate lower interest rates: Contact your credit card company to explore options for reducing interest charges.

- Cut up unnecessary cards: Limit the number of credit cards to reduce the temptation to overspend.

7. Unnecessary Insurance Coverage

Insurance provides financial protection, but having excessive coverage can lead to wasted premiums. Overbuying insurance, failing to review policies regularly, and neglecting to shop around for better rates can drain the wallet.

FAQs on Unnecessary Insurance Coverage:

-

Q: How can I determine if I have too much insurance?

- A: Review insurance policies annually, consider your risk tolerance, and explore options for reducing coverage.

-

Q: How can I find more affordable insurance?

- A: Shop around for quotes from different insurers, consider bundling policies, and explore discounts for safe driving records or home security systems.

Tips for Managing Insurance Costs:

- Review policies regularly: Assess coverage needs and adjust policies accordingly.

- Shop around for better rates: Compare quotes from multiple insurers to find the best value.

- Explore discounts: Inquire about available discounts for safe driving, bundling policies, or home security systems.

Conclusion:

Understanding common financial missteps is crucial for achieving financial stability and reaching long-term goals. By being mindful of spending habits, avoiding impulsive purchases, managing subscriptions effectively, and making informed decisions about transportation, home improvements, credit cards, and insurance, individuals can optimize their financial resources and build a solid financial foundation. Recognizing and addressing these common financial pitfalls empowers individuals to take control of their finances, reduce unnecessary expenditures, and achieve greater financial well-being.

Closure

Thus, we hope this article has provided valuable insights into The American Spending Landscape: A Look at Common Financial Missteps. We hope you find this article informative and beneficial. See you in our next article!