Navigating the Unpredictable: A Comprehensive Guide to Moving House Insurance

Related Articles: Navigating the Unpredictable: A Comprehensive Guide to Moving House Insurance

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Unpredictable: A Comprehensive Guide to Moving House Insurance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Unpredictable: A Comprehensive Guide to Moving House Insurance

Moving house is a significant life event, often accompanied by a whirlwind of emotions and logistical challenges. Amidst the packing, unpacking, and coordinating various services, the potential for unforeseen incidents and damages can easily be overlooked. This is where moving house insurance emerges as a vital safeguard, offering crucial protection against financial losses during a stressful transition.

Understanding the Coverage: A Shield Against Unexpected Mishaps

Moving house insurance, also known as "mover’s insurance" or "transit insurance," acts as a safety net for your belongings during the relocation process. It provides financial compensation for losses or damages that may occur to your possessions while in transit, whether due to accidents, negligence, or unforeseen circumstances. This insurance is typically offered by moving companies themselves or through independent insurance providers.

The Importance of Protection: Why Moving House Insurance is Crucial

While moving companies strive for professionalism and care, accidents can happen. Items can be damaged during loading, unloading, or transit. Unexpected weather conditions, traffic incidents, or even theft can disrupt the moving process and lead to significant financial losses. Moving house insurance acts as a buffer against these unforeseen events, ensuring that you are not left financially burdened by damages or losses.

Types of Coverage: Tailoring Protection to Your Needs

Moving house insurance policies typically offer two main types of coverage:

- Basic Coverage: This standard option provides limited protection for your belongings, usually covering only damages caused by accidents during loading, unloading, or transit. It often excludes damages resulting from inherent defects, pre-existing conditions, or acts of nature.

- Full Coverage: This comprehensive option offers broader protection, covering a wider range of incidents, including damages caused by negligence, theft, and even some natural disasters. It often includes higher coverage limits and may offer additional benefits like replacement value coverage or personal liability protection.

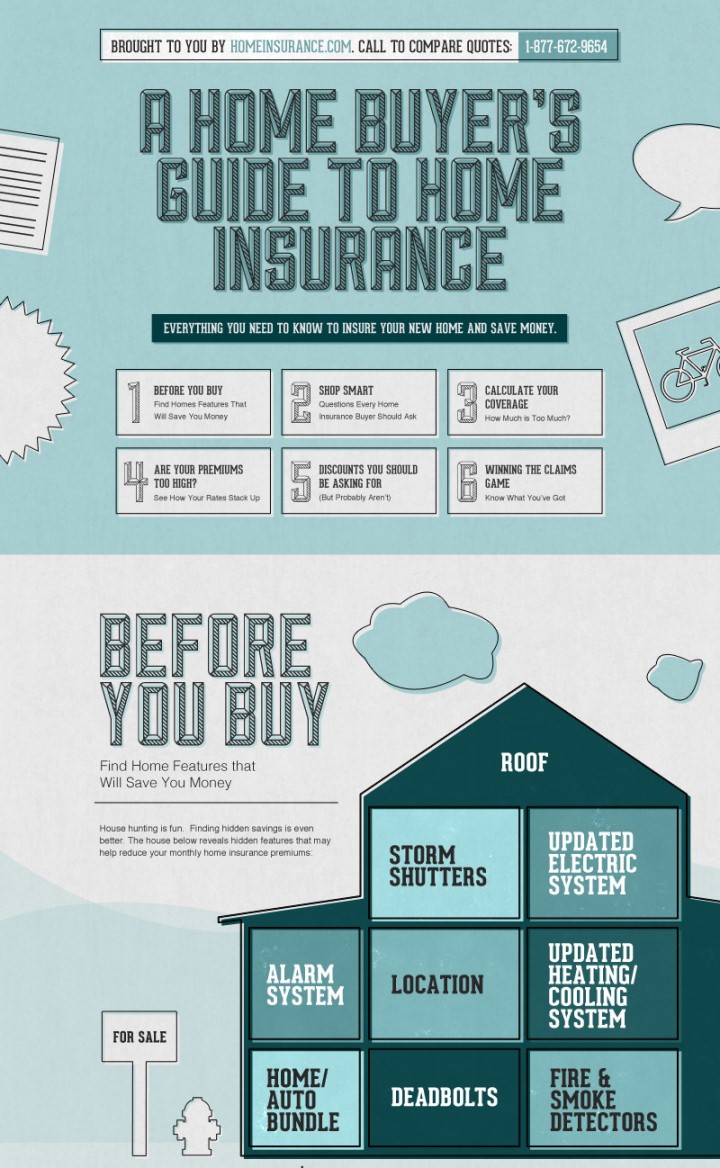

Factors to Consider: Choosing the Right Coverage for Your Move

Selecting the appropriate moving house insurance policy involves careful consideration of several factors:

- Value of Your Belongings: The total value of your possessions plays a crucial role in determining the coverage limit you require.

- Distance of the Move: Longer distances often increase the risk of damages or losses, necessitating higher coverage limits.

- Type of Move: International moves typically involve more complex logistics and potential risks, requiring more comprehensive insurance policies.

- Fragile or High-Value Items: Specific items like antiques, artwork, or electronics may require additional insurance or specialized coverage.

- Budget: While comprehensive coverage provides greater peace of mind, it also comes at a higher cost. Balancing your budget with your risk tolerance is essential.

Key Benefits of Moving House Insurance:

- Financial Protection: It mitigates financial losses due to damages or losses to your belongings during the move.

- Peace of Mind: It provides a sense of security and reassurance, knowing that you are protected against unforeseen incidents.

- Simplified Claims Process: It streamlines the process of filing claims and receiving compensation for covered losses.

- Negotiation Power: Having moving house insurance can strengthen your position when negotiating with moving companies or addressing potential disputes.

Frequently Asked Questions About Moving House Insurance:

Q: What is the difference between moving house insurance and homeowners insurance?

A: Homeowners insurance typically covers damages to your home and belongings while they are at your permanent residence. Moving house insurance specifically protects your belongings during the relocation process, while they are in transit.

Q: Is moving house insurance mandatory?

A: Moving house insurance is not legally mandated, but it is highly recommended, especially for valuable possessions or long-distance moves.

Q: How do I file a claim with my moving house insurance?

A: The claims process varies depending on the insurance provider. Typically, you will need to contact your insurer, provide details of the incident, and submit supporting documentation like photos or receipts.

Q: What are some common exclusions in moving house insurance policies?

A: Common exclusions may include damages caused by pre-existing conditions, inherent defects, acts of war, or intentional acts by the policyholder.

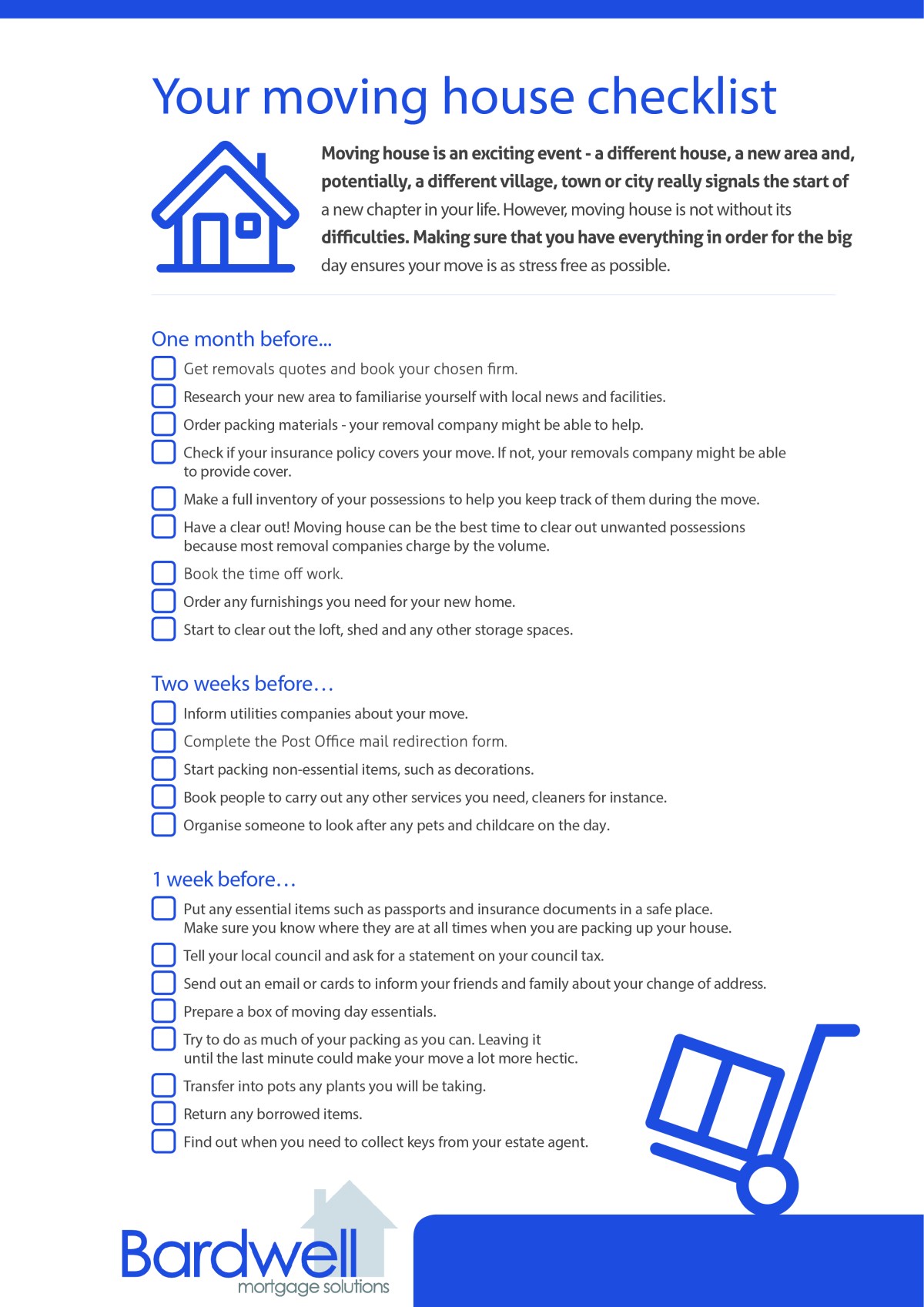

Tips for Maximizing the Benefits of Moving House Insurance:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage options and premiums.

- Read the Policy Carefully: Understand the terms and conditions of your policy, including coverage limits, exclusions, and claim procedures.

- Inventory Your Belongings: Create a detailed inventory of your possessions, including descriptions, purchase dates, and estimated values.

- Take Photos: Document the condition of your belongings before the move, taking photos of any pre-existing damages.

- Communicate with Your Movers: Clearly communicate any concerns or specific instructions to your moving company, ensuring they are aware of valuable or fragile items.

Conclusion: A Prudent Investment for a Smooth Transition

Moving house insurance is a prudent investment that provides valuable protection against potential financial losses during a stressful and often unpredictable period. By carefully choosing the right coverage and understanding the terms and conditions, you can navigate the complexities of relocation with greater peace of mind, knowing that your belongings are adequately insured against unforeseen events. This investment in insurance can make the moving process smoother and less stressful, allowing you to focus on settling into your new home with confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Unpredictable: A Comprehensive Guide to Moving House Insurance. We thank you for taking the time to read this article. See you in our next article!