Navigating the Process: Selling a Property in Probate in the UK

Related Articles: Navigating the Process: Selling a Property in Probate in the UK

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Process: Selling a Property in Probate in the UK. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Process: Selling a Property in Probate in the UK

The passing of a loved one is a deeply personal and challenging experience. Often, it also brings the added complexity of dealing with their estate, which may include the sale of a property. Selling a house in probate in the UK requires a specific set of procedures and considerations, ensuring that the process is handled legally and efficiently. This article aims to provide a comprehensive guide for navigating the legal framework and practicalities involved.

Understanding Probate and Its Impact on Property Sales

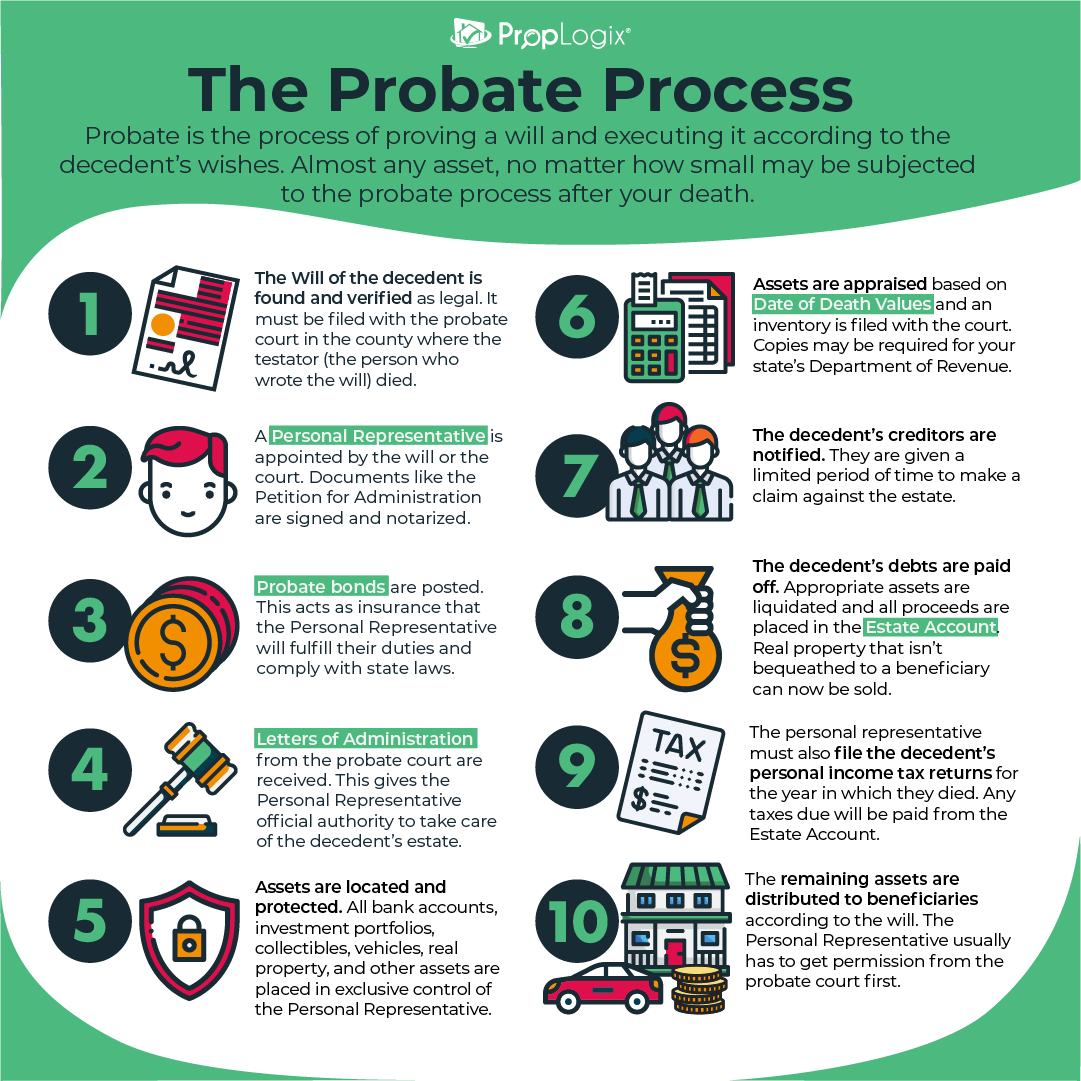

Probate is the legal process of administering the deceased person’s estate. It involves identifying the deceased’s assets, settling their debts, and distributing the remaining assets to their beneficiaries as outlined in their will. When a property is part of the estate, it falls under the jurisdiction of the probate court, which grants permission for its sale.

The Significance of Probate in Property Transactions

Selling a house in probate is distinct from a standard property sale. It requires adherence to specific legal requirements to ensure the validity of the transaction and protect the interests of all parties involved.

- Legal Authorization: The sale of a property in probate needs the explicit approval of the probate court. This ensures that the sale is conducted fairly and aligns with the deceased’s will or intestacy laws.

- Transparency and Accountability: The probate process necessitates transparency and accountability. All transactions related to the property are subject to scrutiny, ensuring that the beneficiaries receive their rightful share of the proceeds.

- Protecting Beneficiary Interests: Probate safeguards the interests of the beneficiaries by ensuring that the property is sold at a fair market value and the proceeds are distributed according to the deceased’s wishes.

Key Steps in Selling a Property in Probate

The process of selling a property in probate involves several crucial steps:

-

Grant of Probate: The first step is obtaining a Grant of Probate from the probate court. This document legally empowers the executor or administrator of the estate to manage the deceased’s assets, including the property.

-

Valuation and Marketing: Once the Grant of Probate is secured, the property needs to be valued by a qualified estate agent. The agent will then market the property to potential buyers.

-

Offers and Negotiations: Offers received from potential buyers will be assessed and negotiated with the executor or administrator, seeking to achieve the best possible price for the property.

-

Legal and Financial Due Diligence: Before proceeding with the sale, both the buyer and seller undergo legal and financial due diligence to ensure the transaction’s validity and minimize risk.

-

Contract Exchange and Completion: Once the terms are agreed upon, the buyer and seller exchange contracts. The completion of the sale involves the transfer of ownership to the buyer and the payment of the agreed-upon price.

Essential Considerations for Probate Property Sales

Selling a property in probate comes with unique challenges and considerations:

- Timeframe: The probate process can be time-consuming, depending on the complexity of the estate and the court’s workload. It is crucial to factor in this time lag when planning the sale.

- Legal Compliance: Strict adherence to probate regulations is essential. Any deviation could lead to delays, legal complications, and potential financial repercussions.

- Emotional Sensitivity: The sale of a property that was once a cherished home can be emotionally charged for the beneficiaries. It is important to approach the process with empathy and understanding.

FAQs: Addressing Common Concerns

1. Who is responsible for paying property taxes and maintenance during the probate period?

The executor or administrator of the estate is responsible for paying property taxes and maintaining the property during the probate period. This includes covering costs such as council tax, utilities, insurance, and any necessary repairs.

2. Can a property in probate be sold before the Grant of Probate is issued?

It is generally not advisable to sell a property before obtaining the Grant of Probate. This can lead to legal complications and potential financial losses for the beneficiaries.

3. Can a beneficiary inherit the property instead of it being sold?

Yes, a beneficiary can inherit the property if it is specifically designated in the deceased’s will or if the beneficiaries agree to share the property. However, it is important to consider the legal implications and potential challenges associated with this option.

4. What happens if the property is in debt?

If the property is subject to debt, such as a mortgage or outstanding bills, the executor or administrator must settle these debts before distributing the remaining proceeds to the beneficiaries.

5. What if there is no will?

If the deceased did not leave a will, the intestacy laws of the UK will determine the distribution of the estate, including the property. In such cases, the court will appoint an administrator to manage the estate.

Tips for a Smooth Probate Property Sale

- Engage Experienced Professionals: Seek the guidance of a solicitor specializing in probate law and an estate agent experienced in handling probate property sales.

- Communicate Effectively: Maintain open communication with all parties involved, including beneficiaries, the executor or administrator, the solicitor, and the estate agent.

- Transparency and Documentation: Ensure all transactions and decisions are documented and transparent.

- Realistic Expectations: Understand that the process may take time and involve unexpected challenges.

- Seek Professional Advice: Do not hesitate to seek professional advice from qualified professionals at each stage of the process.

Conclusion

Selling a property in probate requires careful planning, legal compliance, and a clear understanding of the process. By adhering to the necessary steps, engaging with experienced professionals, and maintaining open communication, beneficiaries can navigate this complex situation efficiently and protect their interests. While the process can be emotionally challenging, it is essential to remember that it is a crucial step in honoring the deceased’s wishes and ensuring a fair distribution of their assets.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Process: Selling a Property in Probate in the UK. We appreciate your attention to our article. See you in our next article!