Navigating the Landscape of Rent-to-Own Household Items

Related Articles: Navigating the Landscape of Rent-to-Own Household Items

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Rent-to-Own Household Items. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Rent-to-Own Household Items

The concept of renting household items is not new. From the days of renting furniture to furnish a new home to the modern practice of subscribing to streaming services, the idea of accessing goods and services without outright purchase has become increasingly popular. However, the specific model of "rent-to-own" for household items offers a unique blend of accessibility and ownership, carving out a distinct niche in the consumer landscape.

Understanding Rent-to-Own: A Closer Look

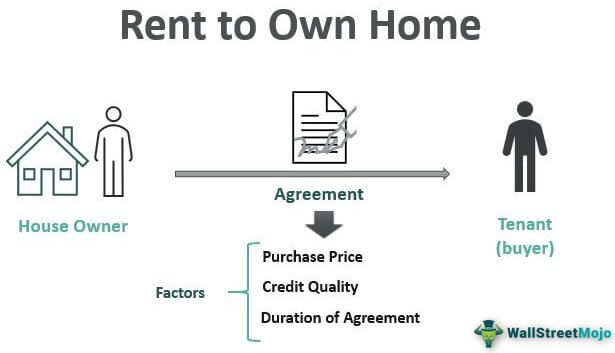

Rent-to-own, in its essence, is a financial agreement that allows individuals to use a product for a predetermined period while making regular payments. Unlike traditional rentals, where the item is returned at the end of the lease, rent-to-own contracts typically include an option to purchase the product outright after a certain number of payments. This option to own, often referred to as a "purchase option," is the defining characteristic of this arrangement.

The Appeal of Rent-to-Own for Household Items

The appeal of rent-to-own for household items lies in its ability to bridge the gap between immediate need and financial limitations. It offers a pathway to acquiring essential items like appliances, electronics, furniture, and even vehicles, without requiring a large upfront investment. This can be particularly beneficial for individuals who:

- Lack the upfront capital for a purchase: A significant upfront payment can be a significant barrier for many, especially those with limited savings or credit access. Rent-to-own allows them to acquire the item immediately and spread the cost over time.

- Are building credit: Regular payments made on a rent-to-own contract can help establish a positive credit history, which can be crucial for accessing larger loans or credit lines in the future.

- Need flexibility: The ability to upgrade or change items as needed can be appealing for individuals whose lifestyle or needs are in flux. Rent-to-own offers a degree of flexibility that traditional ownership may not provide.

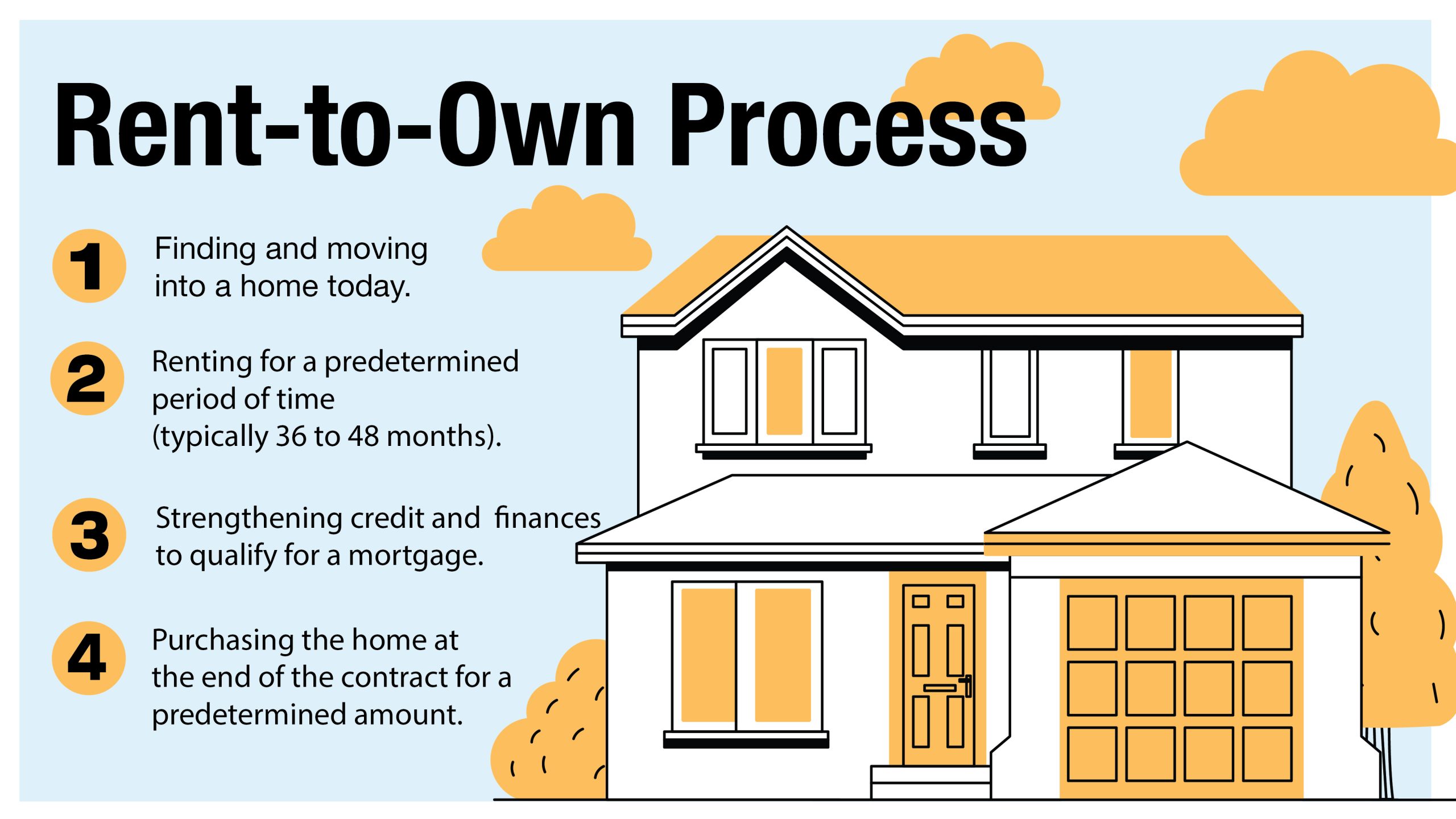

The Mechanics of Rent-to-Own: A Breakdown

The mechanics of rent-to-own agreements can vary depending on the provider and the item being leased. However, the core elements remain consistent:

- Initial Payment: A down payment is typically required at the start of the agreement, which can vary based on the item’s value.

- Regular Payments: Monthly or bi-weekly payments are made throughout the lease term. These payments are often higher than traditional rentals to account for the purchase option.

- Lease Term: The duration of the agreement is predetermined, ranging from a few months to several years, depending on the item and the provider.

- Purchase Option: At the end of the lease term, the renter has the option to purchase the item for a predetermined price, often significantly lower than the original retail value. This price is typically calculated based on the total payments made during the lease period.

- Early Purchase Option: Some providers offer the option to purchase the item before the end of the lease term, usually at a discounted price.

Exploring the Benefits and Considerations

While rent-to-own offers a compelling solution for many, it is crucial to understand both its benefits and potential drawbacks before entering into an agreement.

Benefits:

- Accessibility: Rent-to-own allows individuals with limited financial resources to acquire necessary items.

- Credit Building: Regular payments can establish a positive credit history.

- Flexibility: The ability to upgrade or change items as needed provides a degree of flexibility.

- Potential Savings: The purchase option can result in a lower overall cost compared to financing through traditional loans, especially when considering interest rates and fees.

Considerations:

- Higher Overall Cost: Rent-to-own agreements typically have a higher overall cost compared to outright purchase due to the added fees and interest associated with the purchase option.

- Risk of Default: If payments are not made consistently, the renter could lose the item and any payments already made.

- Hidden Fees: Some providers may charge additional fees for delivery, insurance, or damage.

- Limited Selection: Rent-to-own providers often have a limited selection of items, which may not meet all consumer needs.

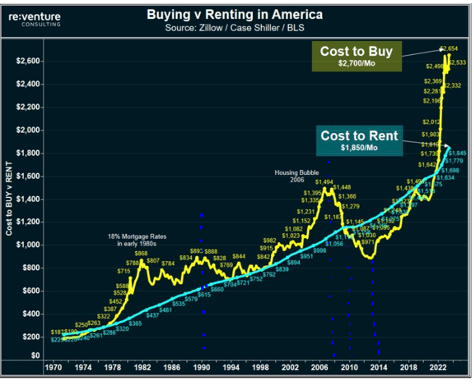

Rent-to-Own: A Comparative Perspective

Understanding how rent-to-own compares to other financing options is crucial for informed decision-making.

- Traditional Loans: While loans offer lower interest rates and flexible repayment options, they often require a higher credit score and a significant down payment.

- Credit Cards: Credit cards provide immediate access to funds but carry high interest rates and can lead to debt accumulation if not managed carefully.

- Savings: Saving up for a purchase is the most cost-effective option but can take a significant amount of time.

Navigating the Rent-to-Own Landscape: Key Considerations

Choosing a rent-to-own provider requires careful research and consideration. Here are some crucial factors to keep in mind:

- Reputation and Reliability: Research the provider’s reputation, customer reviews, and track record.

- Transparency and Disclosure: Ensure the contract terms are clearly explained and disclosed, including all fees, interest rates, and purchase options.

- Item Selection: Consider the provider’s selection, quality, and warranty options.

- Customer Service: Evaluate the provider’s customer service responsiveness and support mechanisms.

- Financial Implications: Thoroughly understand the total cost of the agreement, including fees, interest, and the purchase option price.

FAQs: Addressing Common Questions

Q: What types of household items are typically offered through rent-to-own?

A: Rent-to-own providers offer a wide range of household items, including:

- Appliances: Refrigerators, washing machines, dryers, dishwashers, ovens, and microwaves.

- Electronics: Televisions, computers, laptops, tablets, and gaming consoles.

- Furniture: Sofas, beds, dining tables, chairs, and mattresses.

- Vehicles: Cars, trucks, SUVs, and motorcycles.

Q: How do I know if rent-to-own is right for me?

A: Consider your financial situation, credit history, and need for immediate access to the item. If you lack the upfront capital for a purchase, are building credit, or need flexibility, rent-to-own might be a viable option. However, be sure to carefully weigh the potential costs and risks.

Q: What happens if I can’t make my payments?

A: If you fail to make your payments, the provider may:

- Charge late fees: Late payment penalties can significantly increase the overall cost.

- Repossess the item: The provider has the right to repossess the item if payments are consistently missed.

- Damage your credit: Missed payments can negatively impact your credit score.

Q: Can I return the item if I change my mind?

A: Rent-to-own agreements typically have a limited return period. Once the lease term commences, returning the item may be difficult or impossible, depending on the provider’s policies.

Q: How can I make the most of a rent-to-own agreement?

A: Here are some tips for maximizing the benefits of rent-to-own:

- Shop Around: Compare offers from multiple providers to find the best terms and conditions.

- Read the Contract Carefully: Ensure you understand all fees, interest rates, and purchase options before signing.

- Make Payments on Time: Consistent payments will help build your credit and avoid late fees.

- Consider Early Purchase: If you have the financial ability, consider purchasing the item early to save on interest and fees.

Conclusion: A Balanced Perspective on Rent-to-Own

Rent-to-own can be a valuable tool for individuals seeking access to essential household items without requiring a large upfront investment. It offers a path to ownership, credit building, and flexibility. However, it is essential to approach rent-to-own with a balanced perspective, understanding its potential drawbacks and conducting thorough research before entering into an agreement. By carefully weighing the benefits and considerations, consumers can make informed decisions that align with their financial situation and needs.

:max_bytes(150000):strip_icc()/rent-to-own-homes-final-819c3b46e7094aa4b78f9ad90c05e2ad.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Rent-to-Own Household Items. We appreciate your attention to our article. See you in our next article!