Navigating the Aftermath: A Comprehensive Guide to Post-Death Planning

Related Articles: Navigating the Aftermath: A Comprehensive Guide to Post-Death Planning

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Aftermath: A Comprehensive Guide to Post-Death Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Aftermath: A Comprehensive Guide to Post-Death Planning

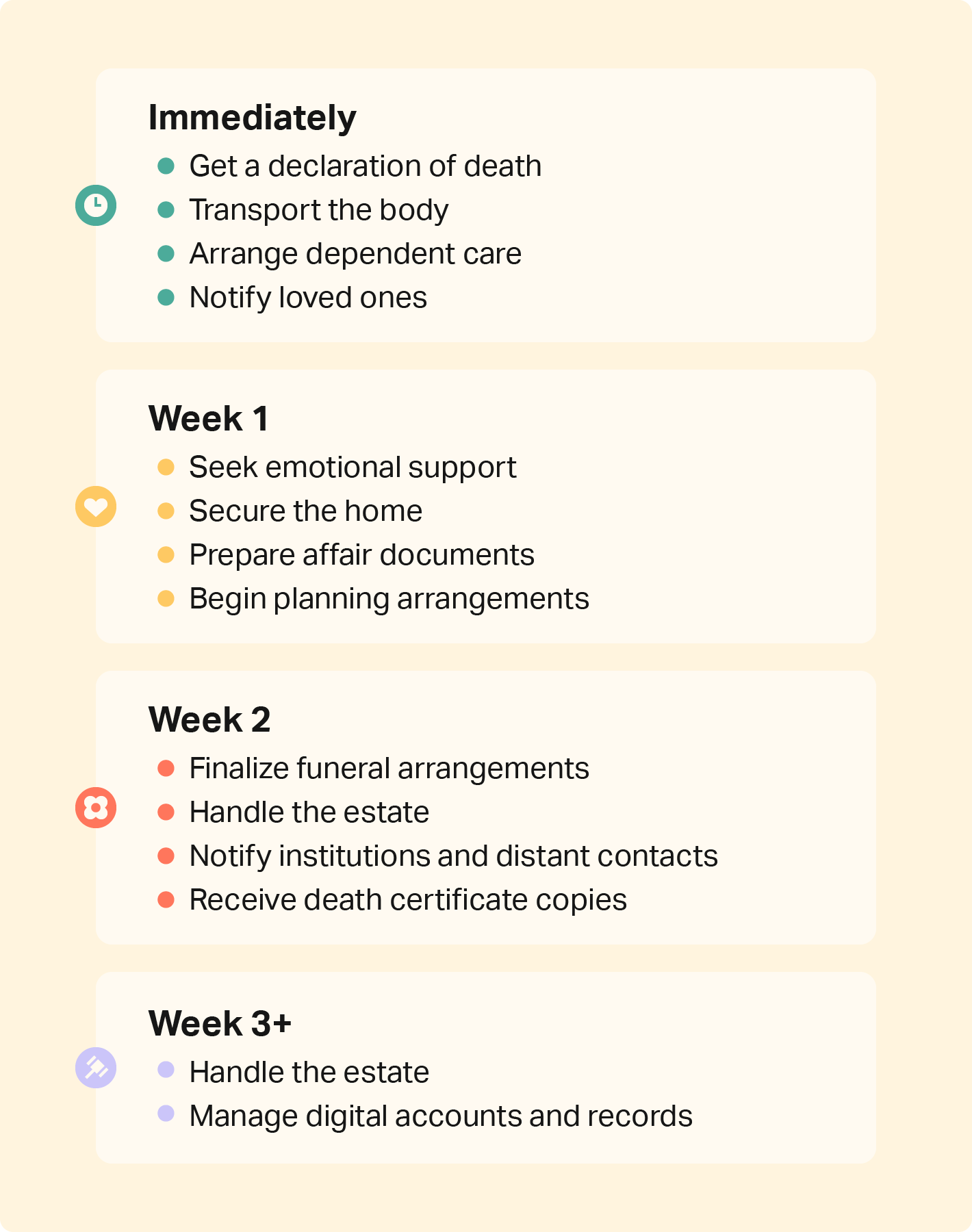

The inevitability of death compels us to confront a complex and often emotionally charged topic: the aftermath. While the finality of death is undeniable, the process of managing the practical and emotional aspects that follow can be navigated with foresight and careful planning. This guide aims to provide a comprehensive understanding of the steps involved in post-death planning, empowering individuals to ensure their wishes are honored and loved ones are supported during a difficult time.

Understanding the Importance of Post-Death Planning

Post-death planning, often referred to as end-of-life planning, is not merely about preparing for the inevitable; it is about ensuring a smooth transition for loved ones and preserving your legacy. It involves making crucial decisions about your final wishes, legal and financial affairs, and the distribution of your assets.

Key Aspects of Post-Death Planning

1. Legal and Financial Affairs:

- Will and Estate Planning: A will is a legal document that outlines how your assets will be distributed after your death. Estate planning encompasses broader financial strategies, including trusts, powers of attorney, and beneficiary designations, which help manage your assets and minimize tax liabilities.

- Power of Attorney: This document designates an individual to make financial and legal decisions on your behalf if you become incapacitated.

- Healthcare Power of Attorney (Advance Directive): This document specifies your wishes regarding medical treatment if you are unable to communicate them yourself.

- Living Will: A living will outlines your preferences for end-of-life care, including resuscitation, life support, and organ donation.

- Beneficiary Designations: Ensure your beneficiaries are accurately listed on retirement accounts, life insurance policies, and other financial instruments.

2. Funeral and Memorial Arrangements:

- Funeral Plans: Preplanning funeral arrangements relieves your loved ones of the burden of making these decisions during a sensitive time. This includes selecting a funeral home, deciding on cremation or burial, and choosing a casket or urn.

- Memorial Services: Consider the type of memorial service you desire, whether it be a traditional religious ceremony, a secular gathering, or a private memorial.

- Final Disposition: Determine your preferences for interment, cremation, or other options, such as donation to science or scattering of ashes.

3. Digital Assets and Legacy:

- Online Accounts: Make arrangements for the management of your online accounts, including social media profiles, email accounts, and online banking. Consider appointing a digital executor to handle these accounts.

- Digital Legacy: Consider preserving digital assets such as photos, videos, and documents for future generations. This may involve creating a digital archive or designating a trusted individual to manage your digital legacy.

- Data Privacy: Address concerns about your online privacy and the potential for misuse of your personal data after your death.

4. Emotional and Spiritual Considerations:

- End-of-Life Care: Discuss your wishes regarding end-of-life care with loved ones, including the possibility of hospice care, palliative care, or home-based care.

- Spiritual and Religious Practices: If you have religious or spiritual beliefs, plan for any rituals or practices you wish to be observed after your death.

- Letters to Loved Ones: Write letters to your loved ones expressing your love, gratitude, and any final messages you want them to receive.

5. Communication and Support:

- Family Meetings: Schedule family meetings to discuss your wishes and ensure everyone understands your plans.

- Support System: Identify trusted individuals who can offer emotional support to your loved ones after your death.

- Professional Assistance: Consider consulting with an attorney, financial advisor, or grief counselor for guidance on specific aspects of post-death planning.

FAQs on Post-Death Planning

Q: When should I start planning for death?

A: It is never too early to begin planning for death. Ideally, you should start as soon as you are financially and legally capable of making informed decisions about your wishes.

Q: Do I need an attorney to create a will?

A: While you can create a will yourself using online resources, consulting an attorney is recommended to ensure your will is legally sound and meets your specific needs.

Q: What happens if I die without a will?

A: If you die without a will (intestate), your assets will be distributed according to your state’s intestacy laws. This may not align with your wishes and could lead to unintended consequences for your loved ones.

Q: How do I choose a funeral home?

A: Consider factors such as location, reputation, services offered, and cost when choosing a funeral home. It is helpful to visit different funeral homes and compare their offerings.

Q: Can I prepay for my funeral arrangements?

A: Yes, many funeral homes offer prepayment options, which can provide peace of mind and ensure your wishes are carried out.

Q: What should I do with my digital assets after death?

A: It is important to designate a digital executor to manage your online accounts, delete unnecessary data, and ensure your privacy is protected.

Tips for Effective Post-Death Planning

- Start early: Don’t wait until the last minute to begin planning.

- Be specific: Clearly express your wishes in writing, leaving no room for ambiguity.

- Review and update: Regularly review and update your plans as your circumstances change.

- Communicate openly: Discuss your plans with loved ones and encourage them to ask questions.

- Seek professional guidance: Consult with legal and financial professionals to ensure your plans are sound and legally compliant.

Conclusion

Post-death planning is a thoughtful and compassionate act that allows you to leave a lasting legacy and provide comfort to your loved ones during a difficult time. By taking the time to carefully consider your wishes and make informed decisions, you can ensure that your final journey is a reflection of your values and that your loved ones are supported in navigating the aftermath. This process is not about dwelling on death, but rather about embracing life and making choices that reflect your values and priorities, ultimately leaving a positive impact on those you care about.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Aftermath: A Comprehensive Guide to Post-Death Planning. We thank you for taking the time to read this article. See you in our next article!