Navigating Property Tax Relief for Seniors in Pierce County, Washington

Related Articles: Navigating Property Tax Relief for Seniors in Pierce County, Washington

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property Tax Relief for Seniors in Pierce County, Washington. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Tax Relief for Seniors in Pierce County, Washington

Pierce County, Washington, recognizes the financial challenges faced by its senior citizens, particularly when it comes to property taxes. To ease the burden and ensure financial stability for this segment of the population, the county offers a dedicated program designed to provide tax relief. This program, often referred to as the "Senior Citizen Property Tax Exemption," allows eligible seniors to significantly reduce their property tax obligations, offering them much-needed financial assistance.

Understanding the Program’s Foundation

The Senior Citizen Property Tax Exemption program is rooted in the belief that seniors, who have contributed significantly to their communities, deserve support during their later years. This program operates under the premise that seniors, often living on fixed incomes, may struggle to keep pace with rising property taxes. By providing a substantial tax reduction, the program aims to alleviate this financial pressure and ensure a more secure financial future for seniors in Pierce County.

Eligibility Criteria: A Clear Path to Qualification

To benefit from this program, individuals must meet specific eligibility criteria. These criteria, established by the county, ensure that the program effectively targets those who require financial support. The primary eligibility requirements include:

- Age: Applicants must be at least 65 years old.

- Residency: They must be legal residents of Pierce County and reside in the property for which they are seeking tax relief.

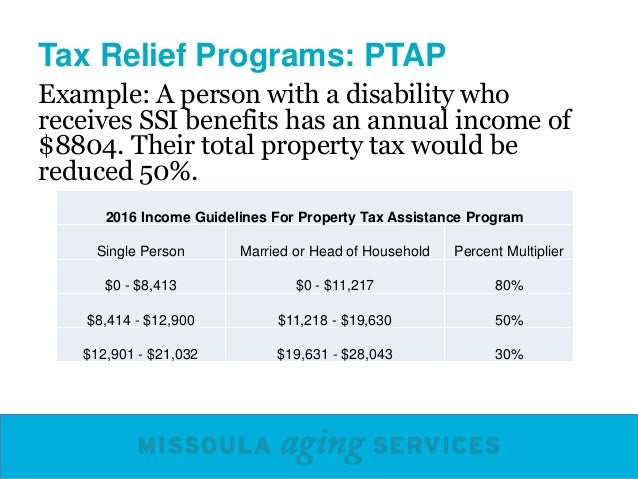

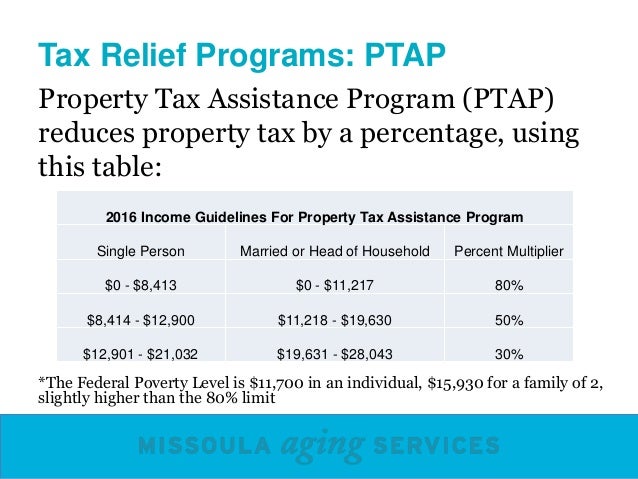

- Income: The applicant’s annual income, including all sources, must fall below a specific threshold established by the county. This threshold is adjusted annually to reflect changes in the cost of living and ensure the program remains relevant.

- Property Ownership: The property must be the applicant’s primary residence and must be owned outright or held through a mortgage.

Application Process: A Step-by-Step Guide

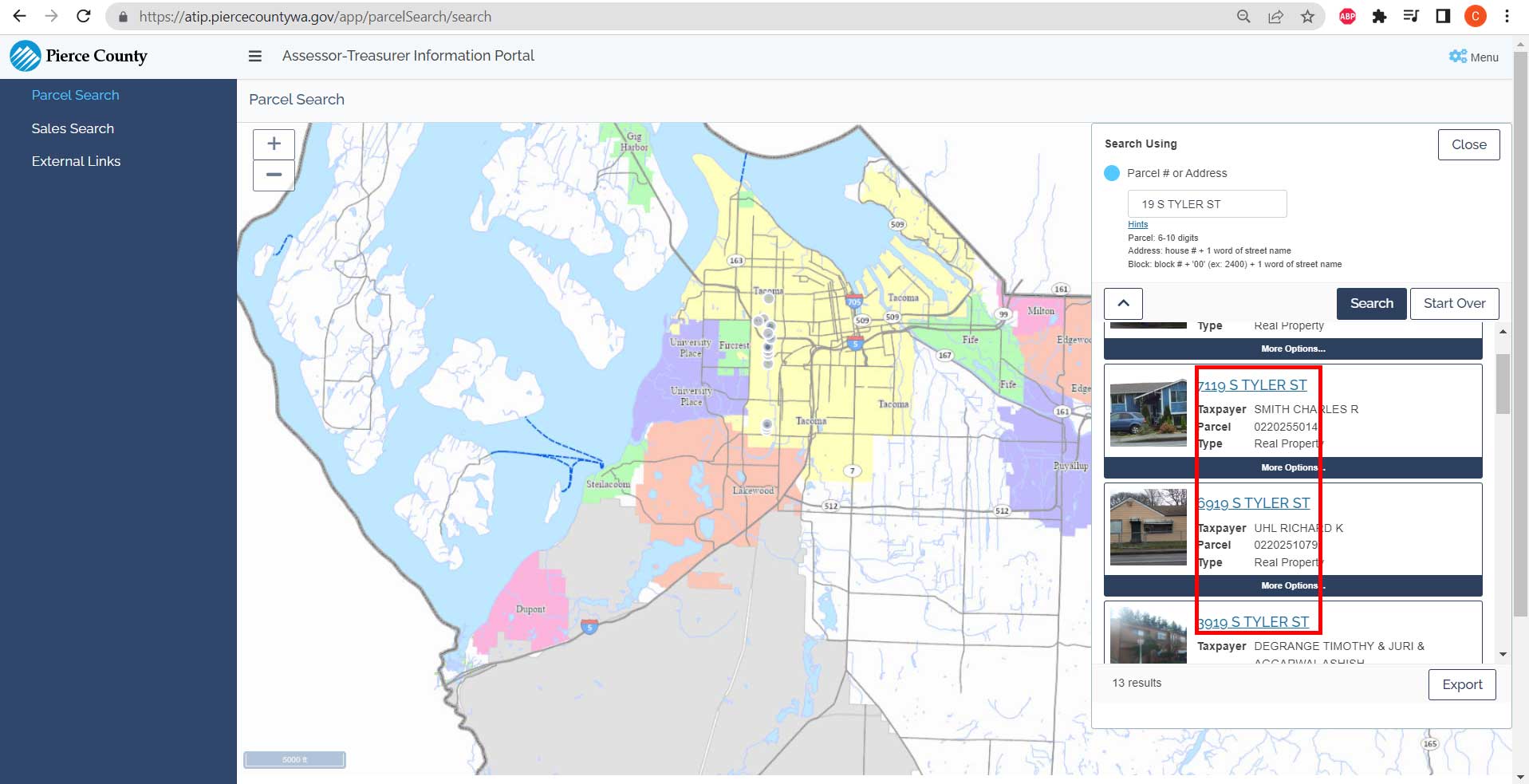

The application process for the Senior Citizen Property Tax Exemption program is designed to be straightforward and accessible. Individuals seeking this relief can access the necessary application forms and instructions through the Pierce County Assessor’s website or by contacting the Assessor’s office directly. The application typically requires the applicant to provide:

- Proof of Age: A copy of their birth certificate or other valid age verification document.

- Proof of Residency: A copy of their driver’s license or utility bill showing their address in Pierce County.

- Income Verification: Copies of their most recent tax returns or other documentation demonstrating their annual income.

- Property Ownership Documentation: A copy of their property deed or mortgage statement.

The application process usually involves a review period during which the Assessor’s office verifies the applicant’s eligibility based on the provided documents. Once approved, the tax exemption will be applied to the applicant’s property taxes for the current tax year.

Benefits of the Program: A Tangible Impact on Seniors’ Lives

The Senior Citizen Property Tax Exemption program offers significant benefits to eligible seniors, providing them with financial stability and peace of mind. The key benefits include:

- Reduced Property Tax Burden: The program significantly reduces the amount of property taxes seniors are required to pay, freeing up valuable financial resources for other essential needs like healthcare, medication, and everyday living expenses.

- Financial Security: The program helps seniors maintain financial stability, reducing the risk of falling behind on their property taxes and potentially facing foreclosure. This allows them to remain in their homes and continue living independently.

- Improved Quality of Life: By alleviating financial stress, the program contributes to a higher quality of life for seniors, allowing them to focus on their health, well-being, and personal pursuits.

FAQs: Addressing Common Queries

1. What is the income limit for the Senior Citizen Property Tax Exemption?

The income limit for eligibility varies annually and is adjusted based on changes in the cost of living. It is crucial to refer to the most recent guidelines published by the Pierce County Assessor’s office for the current income threshold.

2. Can I apply for the exemption if I own my property jointly with someone who is not eligible?

Generally, the property must be owned solely by the eligible senior or jointly owned with another eligible senior. If the property is jointly owned with someone who does not meet the eligibility requirements, the exemption may not be granted.

3. What happens if my income exceeds the limit after I have been approved for the exemption?

If your income exceeds the eligibility limit after being approved for the exemption, you may be required to repay a portion of the tax relief received. It is important to notify the Assessor’s office of any significant changes in your income to ensure you remain eligible.

4. How often do I need to reapply for the exemption?

The Senior Citizen Property Tax Exemption is typically renewed annually. You will need to reapply each year to ensure continued eligibility. The Assessor’s office will send out renewal notices to eligible seniors, providing instructions on how to reapply.

5. Can I apply for the exemption if I am receiving Social Security benefits?

Social Security benefits are considered income and will be factored into the overall income calculation for eligibility. However, receiving Social Security benefits alone does not automatically disqualify you from the program.

Tips for Success: Maximizing Your Chances of Eligibility

- Gather Necessary Documents: Ensure you have all the required documentation, including proof of age, residency, income, and property ownership, before submitting your application.

- Review Eligibility Requirements: Carefully review the eligibility criteria and ensure you meet all the requirements before applying.

- Contact the Assessor’s Office: If you have any questions or require clarification on the application process or eligibility criteria, contact the Pierce County Assessor’s office directly.

- Seek Professional Assistance: If you are unsure about any aspect of the application process or have difficulty navigating the requirements, consider seeking assistance from a tax advisor or legal professional.

- Stay Informed: Keep abreast of any changes to the program’s eligibility criteria or income limits by visiting the Pierce County Assessor’s website or contacting their office.

Conclusion: A Vital Program for Seniors in Pierce County

The Senior Citizen Property Tax Exemption program serves as a vital lifeline for seniors in Pierce County, providing them with significant financial relief and ensuring their ability to maintain their independence and quality of life. By understanding the eligibility criteria, navigating the application process, and staying informed about program updates, eligible seniors can benefit from this valuable program and secure a more stable financial future.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Tax Relief for Seniors in Pierce County, Washington. We hope you find this article informative and beneficial. See you in our next article!